MyBiz

If you have a Limited Liability Company or plan to Incorporate one, these forms MUST be filed.

Limited Liability Companies, unlike Sole Traders, may have multiple owners.

Contrary to common belief, the actual owners of a Limited Liability Company aren't the directors; they're the Beneficial Owners who may own shares in the Company. Shares determine the percentage of the Company that each owner possesses; therefore, the owners are often referred to as shareholders.

It is common practice for Money Launderers and corrupt individuals to incorporate a Limited Liability Company and appoint directors to be the face of the Company while secretly running the Company and benefiting from behind the scenes. The Government introduced the Beneficial Ownership forms to combat this.

In simple terms, a beneficial owner is the person who ultimately receives the benefits and controls the assets, even if they are not the legal owner on paper. It's the person who truly enjoys the advantages and bears the risks associated with the asset, even if it's held in someone else's name. The beneficial owner must be a natural person only (cannot be another company).

The term refers to various forms used to disclose and record information about the true owners of assets or companies, even if they're not the legal owners on paper. These forms are crucial for promoting transparency, combating financial crime, and ensuring compliance with regulations.

The forms that are most commonly filed for newly incorporated Limited Liability Companies are form 40, form 42, form 45, and form 46.

The Notice to Shareholders of the Company to Declare Non-Beneficial Ownership is used to inform shareholders of their obligation to declare non-beneficial ownership of their shares in the company, as per section 337C(1) of the Companies Act, Chapter 81:01 (as amended by the Companies (Amendment) Act, No. 6 of 2019).

The Declaration of Beneficial Ownership plays a key role in disclosing the true owners of shares in a company, even if those owners are not directly listed in the company's register of members. This declaration must be witnessed by a Commissioner of Affidavits or Notary Public.

The Return of Beneficial Interest in the Shares of a Company (form 45) is required by the Companies (Amendment) Act, CH. 81:01. Its main purpose is to disclose the true owners of shares in a company, even if those owners are not directly listed in the company's register of members. This helps to increase transparency and combat financial crime.

The Form 46 is the Return of Issuance or Transfer of Shares.

Its main purpose is to record and publicly disclose any changes in the ownership of shares within a company.

The Return of Beneficial Interest in the Shares of a Company and the Return of Issuance or Transfer of Shares must both be files 30 days of incorporating the company, declaration of beneficial ownership or issuance / transfer of shares.

The failure by either a shareholder or a beneficial owner to file a declaration, as prescribed, is an offence punishable on summary conviction (i.e. in the magistrates’ courts) by a fine of ten thousand dollars ($10,000) and three (3) years’ imprisonment and a further fine of three hundred dollars ($300) per day for every day in which the offence continues.

To identify the beneficial owner, the company must analyze its corporate structure to determine the natural person or persons in control of the management and affairs of the company. This involves considering:

MyBiz would file all thse forms and get the form 42 sworn in by a Commissioner of Affidavits. All you have to do is sign.

MyBiz became necessary to keep companies compliant and out of the legal issues that arise from an inaccurate (or incomplete) incorporation.

Due to the strict criteria and new process, many applicants are discouraged or unsuccessful in registering their companies had it not been for MyBiz.

The Ministry has also sent numerous letters to individuals who incorporated their companies incorrectly or incompletely.

In addition to letters, the Office of the Attorney General and Ministry of Legal Affairs publishes warnings like the one below:

Non-compliant company incorporations incur severe penalties and even imprisonment.

The Main Benefits of MyBiz are:

Beneficial Ownership Form Requirements:

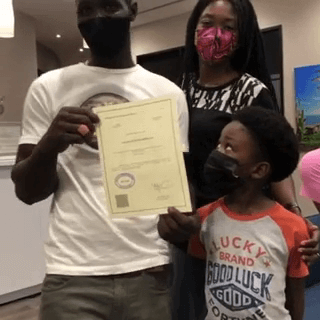

A picture is worth a thousand words.

Even behind the mask you can see the smiles :-)

If you have any questions, feel free to contact us.