MyBiz

Congratulations on your decision to start your own Business in Trinidad and Tobago. If set up correctly, it'll become the best money-generating machine in your life; but it can be a nightmare of legal issues and penalties if done incorrectly.

The registration process has changed drastically. As a result, there is a much more significant focus on the accuracy of the paperwork and legal compliance.

The Ministry of Legal Affairs issues all certificates of registration. MyBiz is a private company that works alongside the Ministry of Legal Affairs to register businesses on behalf of the public. All documents are compliant and filed with the Company Registry so that the business is registered legally in the Republic of Trinidad & Tobago.

Due to the strict criteria and new system, many applicants are discouraged or unsuccessful in registering their businesses.

The Ministry has also sent numerous letters to individuals who registered their business incorrectly.

Also, Improper registrations incur penalties due to a lack of compliance.

Because of the numerous verification checks and impeccable understanding of the criteria and laws governing

Business Registration,

MyBiz became necessary to keep Businesses compliant and out of legal issues that arise from an inaccurate registration.

The Main Benefits of MyBiz are:

First, decide on your Business' type: Sole Trader, Firm / Partnership, or Limited Liability Company.

Sole Trader - A Sole Trader is a business owned by a single person known as the proprietor. The owner is personally liable for any debts incurred when operating the business.

Firm / Partnership - A business that two or more persons own. You may also form a Partnership between persons and companies or other firms. Each partner is liable for any debts incurred by the firm.

Limited Liability Company - A Limited Liability Company, as the name suggests, limits the liability of its directors and shareholders. The company is a legal entity by itself and therefore protects its directors and shareholders from any debt and legal issues that arise against the company.

Sole Trader Requirements:

Partnership Requirements:

Limited Liability Company Requirements:

Before being allowed to proceed with your registration, you must first get your name

approved and reserved. Unfortunately, most people mistakenly think they can automatically get a business name if it's

available.

That couldn't be further from the truth, and the reason is mainly that the name doesn't meet the criteria and legislation

outlined in the "Registration of Business Names Act."

Of course, cooperating with the MyBiz Application manager would solve this for you, making this part of the process a

breeze. In addition, all MyBiz representatives fully understand the legislative criteria for naming and registering

businesses, as they have repeatedly done so for thousands of applicants every month.

After the Companies Registry reserves the name you would like to register, the next immediate step is submitting the business registration since the name reservation expires after a couple of weeks.

The Registration of Business Names Act is currently a 34-page legal document

that outlines the particulars for registering businesses and filing changes.

It also outlines the penalties for inaccurate and misleading information.

In addition to the business registration form, the MyBiz Application Manager

would attach various documents like an annexed schedule, qualifications, utility records,

and other supplemental paperwork depending on the nature of the business.

The business registration documents must be "approved in principle" by the Ministry of Legal Affairs

before the Applicant can sign them.

MyBiz then prints the pre-approved forms and presents them to the proposed business owner for a signature.

The signed forms are then exchanged for the Certificate of Registration at the Ministry of Legal Affairs - Company Registry.

Like a Business Registration, after the Companies Registry reserves the name you would like to register, the next immediate step is submitting the company incorporation documents since the name reservation expires after a couple of weeks.

The "Companies Act" is the law that governs the incorporation of Companies and is currently a 627-page document.

It outlines many compliance documents that one must declare after the company's incorporation.

There are severe penalties and jail time for incorrect or lack of declarations.

The company incorporation documents must be "approved in principle" by the Ministry of Legal Affairs before the

incorporator and director can sign them. MyBiz then prints the pre-approved articles of incorporation in duplicate

and presents them to the director for a signature.

The signed articles are then exchanged for the Certificate of Incorporation at the

Ministry of Legal Affairs - Company Registry.

Not filing the following post-incorporation documents would attract severe penalties:

A Corporate Secretary (not to be confused with an administrative secretary) must be appointed within 30 days of the company's incorporation.

The Beneficial Owners declaration is a collection of around four forms, forms 40, 42, 45, and 46.

They're designed to ensure transparency concerning the beneficial ownership of companies incorporated under the

Companies Act Ch. 81:01, i.e., its shareholders.

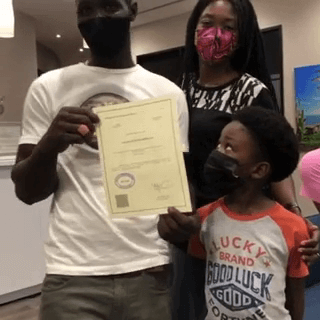

A picture is worth a thousand words.

Even behind the mask you can see the smiles :-)

Although they are often used interchangably, technically, a "Business" is used to refer to a Sole Trader, whereas "Company" refers to Limited Liability.

Here are some reasons why you should register your business:

Yes, a non-national may register a Company in Trinidad & Tobago, however,

the total amount of shares that all foreign shareholders can control is 40%.

There are a few more considerations that our Online Business Registration process takes into account,

such as the nationality of the directors, and if the Company wishes to operate as an External Company (see below for definition) etc.

An External Company (also referred to as a Foreign Company) is one that was incorporated outside of Trinidad & Tobago but is allowed to conduct business within Trinidad & Tobago. Non-nationals can also Incorporate a Limited Liability Company that does not operate as a External one.

The Online Business Registration process is very fast and simple:

A Sole Trader business is one that is owned by a single individual, and where the business owner is personally responsible for all debts incurred by the business. Basically, the individual is the business. Many professionals choose to register as a Sole Trader because it is the easiest to manage;. In the United States, a Sole Trader business structure is commonly referred to as Sole Proprietorship.

Some Advantages of a Sole Trader business are:

A Sole Trader pays his / her usual taxes - Income Tax, Health Surcharge. If hiring employees, a Sole Trader must also apply for a PAYE number.

A Limited Liability Company is one that offers protection to its owners, commonly referred to as directors, and is incorporated

by multiple individuals.

The company becomes a legal entity by itself and therefore pays its own taxes seperately from its directors.

Being a legal entity also means that its directors cannot be held personally responsible for the company's debts or liabilities.

Think of the Company as its own person.

Limited Liability company names are given the "Ltd" suffix in Trinidad & Tobago.

In the United States, the suffix is LLC.

| Word | Meaning |

|---|---|

| Limited | A Restriction on something. |

| Liability | Legal Obligations. |

| Company | A business. |

| Therefore, a Limited Liability Company is a business that restricts liabilities. | |

|

|

|---|---|

| Sole Trader | Limited Liability |

| Single owner | Multiple owners/directors |

| One owner makes all the decisions | Multiple directors share the responsibilities of decision making. |

| Individual owns 100% of the business and keeps all of the profits | Profits are shared amongst all the directors; although profits are usually kept in the Business' account, and the directors draw a salary. |

| The owner is the Business; they are considered the same entity | The Company is considered to be a seperate entity from the individuals that own it. |

| A Sole Trader company ceases to exist when the owner dies, retires or unregisters the business. | A Limited Liability Company can go on indefinitely and has an operating agreement that makes provisions for continuing the company in the event of an owner's death, resignation or retirement. |

| The owner's personal assets are the business' assets | The owners' personal assets are protected. The Company has its own assets. |

| No Name Suffix | Company name has an "Ltd" or "Limited" suffix |

That depends on your vision. If you're a self-employed professional who's looking for a quick & simple start, then Sole Trader may be your best option.

If you have co-owners / directors in mind that would like to join your business venture;

or you plan to own an establishment with employees, then Limited Liability is more conducive to your goals.

Yes. The process involves de-registering the Sole-Trader, while simultaneously applying for a Limited Liability with the same name.

The requirements for registering a Sole Trader Business are:

The requirements for registering a Limited Liability Company are:

Our Online business registration process can take roughly around 5 minutes for Sole Traders and 10-15 minutes for Limited Liability Companies.

The cost of registering a Business in Trinidad depends on the Business' Structure i.e. the type of Business that you wish to register (Limited Liability, NGO, Partnership, SoleTrader).

There are various costs associated with the Ministry's entire Business Registration Process.

| Package | Cost |

|---|---|

| Sole Trader (Minimum) | $750 TTD |

| Sole Trader (FULL) | $895 TTD |

| Partnership (Minimum) | $1007 TTD |

| Partnership (FULL) | $1232 TTD |

| Limited Liability (Minimum) | $1900 TTD |

| Limited Liability (FULL) | $2485 TTD |

FULL packages also include a Business Stamp and BIR Registration (for Limited Liability Companies).

We Accept the following Payment Methods:

The Ministry of Legal Affairs, Registrar General Department is responsible for maintaining the Companies Registry in Trinidad & Tobago. Other responsibilities of the Minisitry of Legal Affairs include:

Corporate Secretaries are the Company’s named representative on legal documents, and it is their responsibility to ensure that the company and its directors operate within the law.

Not to be confused with a regular Secretary (Administrative Assistant), the Corporate Secretary or Company Secretary is a senior official (male or female) on the board of a company. He / She is responsible for ensuring that the organisation complies with relevant legislation and regulation, and keeps board members informed of his / her legal responsibilities.

A tax-deductible expense is one that you do not have to pay taxes on. Let's say for example you've made $100,000 dollars. Normally, you'll have to pay Income Tax on it. If you make a tax-deductible purchase of $20,000, then you'll only have to pay income tax on $80,000

If you have any questions, feel free to contact us.